Four-Wheeler Loan

Interest Rate: upto 9% p.a.

- Home

- Four-Wheeler Loan

Drive Your Dream Car with a Four-Wheeler Loan

Owning a four-wheeler is not just a luxury—it’s a necessity that brings comfort, freedom, and convenience to your everyday life. Whether you’re upgrading your family vehicle, buying your first car, or investing in a utility vehicle for work, a Four-Wheeler Loan helps you turn that goal into reality without a financial burden.

With attractive interest rates, flexible EMIs, and quick disbursal, a four-wheeler loan is designed to suit every budget and lifestyle. Say goodbye to long waits and heavy down payments—drive home your dream car with simple financing.

Secure Four-Wheeler Loan up to ₹50 Lakhs

- Minimal documentation

- Flexible tenure up to 60 months

- Loan amount of up to ₹ 50 lakh

- Attractive interest rates starting @ 1%

Four-Wheeler Loan EMI Calculator

₹0

₹0

₹0

₹0

What is a Four-Wheeler Loan?

A four-wheeler loan is a secured loan offered by banks, NBFCs, and cooperative societies to help individuals purchase new or pre-owned cars. These loans typically cover up to 90%-100% of the on-road price and come with easy repayment tenures of up to 7 years.

Designed for salaried professionals, self-employed individuals, and business owners, a four-wheeler loan provides financial flexibility while ensuring that you remain in control of your vehicle ownership journey.

Low Down Payment

Affordable Interest Rates

Flexible Repayment Options

Quick and Easy Processing

New & Pre-Owned Cars

No Income Proof Options

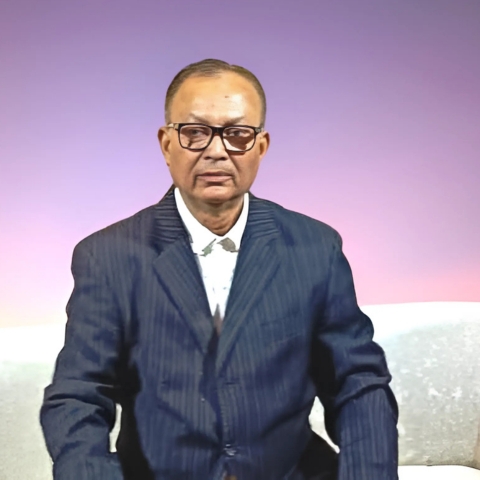

Who Can Apply?

- Salaried employees with a stable income

- Self-employed professionals and business owners

- Farmers and rural residents (with alternative income verification)

- First-time borrowers with co-applicants

- Existing vehicle owners upgrading their car

Required Documents

- Identity Proof (Aadhar, PAN, Passport, etc.)

- Address Proof (Utility bills, Rent agreement, etc.)

- Income Proof (Salary slip, Bank statements, ITR)

- Vehicle Quotation from Dealer

- Passport-sized photographs

- Business proof (for self-employed applicants)

Loan Features at a Glance

- Compare loan offers from different providers before deciding

- Maintain a good credit score for better interest rates

- Ensure timely EMI payments to avoid penalties

- Understand processing fees, foreclosure charges, and other terms

- Opt for loan protection insurance if available

- Don’t skip reading the fine print in the agreement

- Don’t default on existing loans when applying for a new one

- Don’t borrow beyond your repayment capacity

- Don’t rely solely on verbal promises—get everything in writing

- Don’t delay submitting required documents for faster approval

Best Use Cases

- Daily city commute

- Long-distance family travel

- Business logistics and travel

- Safe transportation for senior citizens and children

- Travel comfort during bad weather or emergencies

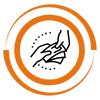

Application Submission

Application Submission

Document Verification

Document Verification

Loan Processing

Loan Processing

Approval & Disbursal

Approval & Disbursal

Vehicle Delivery

Vehicle Delivery

Repay Monthly EMIs

Repay Monthly EMIs

Application Submission

Application Submission

Document Verification

Document Verification

Loan Processing

Loan Processing

Approval & Disbursal

Approval & Disbursal

Vehicle Delivery

Vehicle Delivery

Repay Monthly EMIs

Repay Monthly EMIs

Application Submission

Application Submission

Document Verification

Document Verification

Loan Processing

Loan Processing

Approval & Disbursal

Approval & Disbursal

Vehicle Delivery

Vehicle Delivery

Repay Monthly EMIs

Repay Monthly EMIs

Application Submission

Application Submission

Document Verification

Document Verification

Loan Processing

Loan Processing

Approval & Disbursal

Approval & Disbursal

Vehicle Delivery

Vehicle Delivery