Vehicle Loan

Interest Rate: upto 12% p.a.

- Home

- Vehicle Loan

Get the Keys to Freedom with a Vehicle Loan That Fits Your Life

A vehicle isn’t just a means of transportation—it’s a gateway to convenience, independence, and better opportunities. Whether you’re planning to buy a new car, a two-wheeler, or a commercial vehicle for your business, a vehicle loan helps you achieve your goal faster and more affordably.

Our vehicle loan solutions are designed to meet your personal and professional needs—offering competitive interest rates, quick approvals, and flexible repayment options. Start your journey today without compromising your savings.

What is a Vehicle Loan?

A vehicle loan is a financial product that allows you to purchase a vehicle by borrowing money from a lender and repaying it over time in affordable monthly installments. It’s a secured loan, where the vehicle itself serves as collateral until the loan is fully repaid.

Whether you’re a first-time buyer or looking to upgrade, vehicle loans help make your dream ride a reality—without the burden of a one-time payment.

Vehicle Loan EMI Calculator

₹0

₹0

₹0

₹0

Features of Our Vehicle Loan

- Choose your desired vehicle and apply for a loan.

- The lender reviews your credit profile and income.

- Based on eligibility, the loan amount is approved—typically up to 90% of the vehicle’s on-road price.

- The loan amount is disbursed directly to the vehicle dealer or your account.

- You repay the loan in EMIs over your chosen tenure.

Who Can Apply?

- Salaried professionals looking for a personal car or bike.

- Self-employed individuals seeking commercial vehicles.

- First-time buyers and families looking to upgrade.

- Small business owners expanding transportation assets.

Benefits of a Vehicle Loan

Drive Now, Pay Later

Preserve Cash Flow

Keep your savings intact while enjoying convenient repayment options.

Boost Mobility and Efficiency

Whether personal or professional, enhance how you travel and operate.

Tailored Solutions

Get customized loan amounts and tenures suited to your financial goals.

Credit Building

Repaying your loan on time strengthens your credit score and opens doors to future financing.

Quick Approval

Our simplified approval process ensures minimal waiting time.

Insurance Integration

Get comprehensive insurance coverage easily bundled with your loan.

Eligibility Criteria

To apply for a vehicle loan, you should:

Be between 21 and 65 years old.

Have a regular source of income (job, business, or profession).

Possess essential KYC and income documents.

Maintain a healthy credit profile (preferably 650+).

We assess each case individually, so even if you’re new to credit, you still have a fair chance of approval.

Documents Required

- KYC Documents: Aadhaar, PAN, Passport, or Voter ID.

- Address Proof: Utility bill, rent agreement, or passport.

- Income Proof: Salary slips, bank statements, ITR.

- Vehicle Invoice: Quotation or proforma from the dealer.

- Business Proof: (If self-employed).

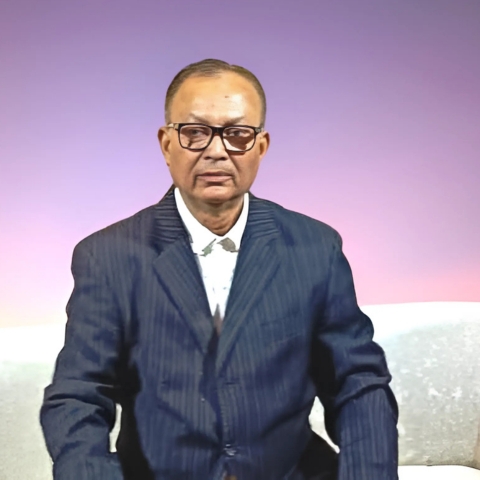

Real-Life Example

Why Choose a Vehicle Loan?

When you need a reliable way to finance your next vehicle, a vehicle loan offers:

Financial Flexibility

Financial Flexibility

Peace of Mind

Peace of Mind

Fast & Easy Access

Fast & Easy Access

Wide Coverage

Wide Coverage

Make the Right Move—Apply Today

Whether you’re purchasing your first vehicle, upgrading your ride, or expanding your business fleet, a vehicle loan helps you make it happen efficiently and affordably. We’re here to support your goals with smart financing, expert assistance, and a loan process that puts you first.

Take the next step. Apply for your vehicle loan today and drive home with confidence.